We view CCR as the first big initial step towards an Open Banking regime – it puts power back in the hands of Consumers who have shown they’re responsible borrowers.

CCR Data Supply - CCRDS

Simplified, Automated Solution to be CCR Compliant

CCR Data Supply - CCRDS

Simplified, Automated Solution to be CCR Compliant

We view CCR as the first big initial step towards an Open Banking regime – it puts power back in the hands of Consumers who have shown they’re responsible borrowers.

Comprehensive Credit Reporting Data Supply (CCRDS)

FinSS Global’s Comprehensive Credit Reporting Data Supply (CCRDS) application has been built from the ground up to enable Credit Providers to supply positive Customer Credit Data to 1 or many Credit Bureaux.

The product supports all Credit Provider products (e.g. Home Loan, Personal Loan, Credit Card, Overdraft, etc) and the semi-automated sending of this data securely to their chosen Credit Bureaux.

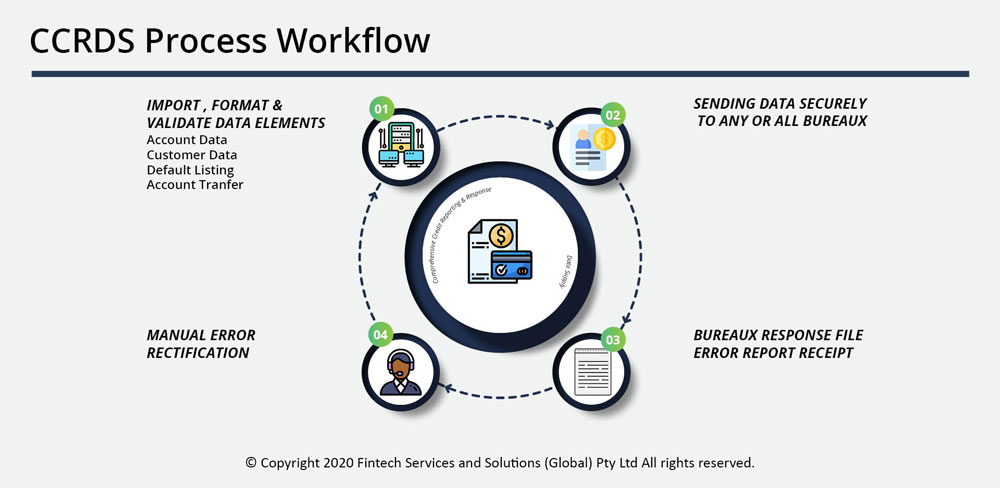

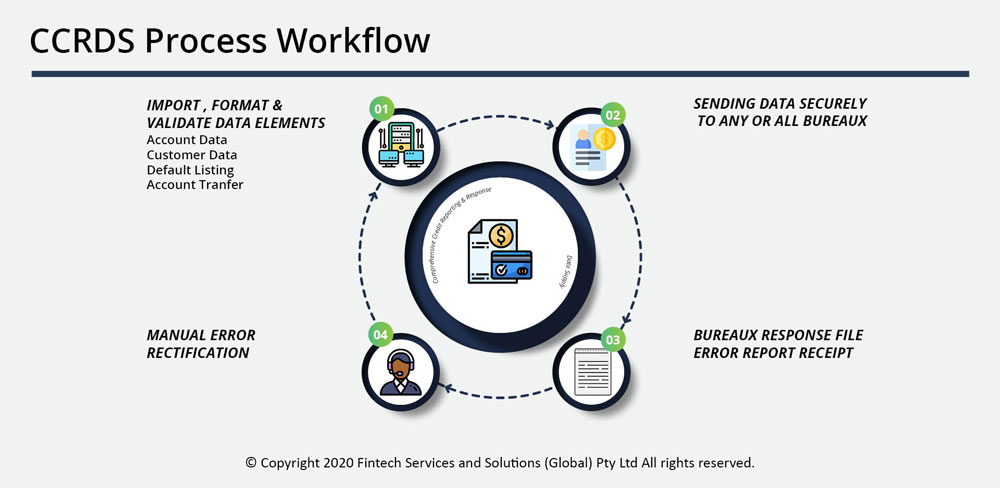

CCRDS formats and validates all necessary data elements against the Australian Retail Credit Association (ARCA) Data Standards, sends it to the Credit Bureaux and manages the receipt of their Response Files, including status and error notifications.

FinSS Global’s Comprehensive Credit Reporting Data Supply (CCRDS) application has been built from the ground up to enable Credit Providers to supply positive Customer Credit Data to 1 or many Credit Bureaux.

The product supports all Credit Provider products (e.g. Home Loan, Personal Loan, Credit Card, Overdraft, etc) and the semi-automated sending of this data securely to their chosen Credit Bureaux.

CCRDS formats and validates all necessary data elements against the Australian Retail Credit Association (ARCA) Data Standards, sends it to the Credit Bureaux and manages the receipt of their Response Files, including status and error notifications.

CCRDS Semi-Automated Workflow

CCRDS Semi-Automated Workflow

CCRDS Product Features

CCRDS Product Features

Designed and Architected

Support for multiple versions of the ARCA Standards

Dashboard showing status, statistics and success of all events/processes

Important notifications via SMS and/or email

Fully customizable integration points and configurable semi-automated processes for data supply/receipt which minimize Customer effort and engagement with Credit Bureaux

Be implemented per Customer or as a Multi-tenant solution for Managed Service Providers

SaaS Model

Reduce implementation and configuration time and cost

Include maintenance and support for bug fixes and minor enhancements

Like all software products, version upgrades or major new Product releases will be based on upgrade or new product fees

Make CCR Compliance Simple, Automated and Cost-effective

– CCRDS makes CCR RoI achievable from the first year –

Key Technical Features

Built to Scale & Perform

• Built using standard Open Source technology.

• Frontend – ReactJS.

• Backend – Java, Spring Boot, OrientDB (In-memory SQL), API/Microservices.

Totally Configurable

• Provides custom report templates, endpoints & notifications.

• Configurable data elements and levels of automation.

• Supports different versions of ARCA standards.

Modern User Experience

• Provides fast, reliable, simple & latest UX.

• Screen skins can be configured to match Customer look and feel.

• Usability tested by several Credit Reporting experts validating the UX.

Complete Data Security – Internal & External

• User access is controlled by secure role-based uid/pwd.

• System integrates with Cloud or Managed Service Security Protocols.

• File Transfers are secured by SFTP, PGP and Private Keys.

Industry Expertise & Support

• Support is local through a local number, email and contact.

• Price includes Maintenance and Support.

Built to Support Automation

• Supports automated processes & notifications

• SMS, email, file upload/download, report generation and more.

Open API/Microservices enabled

• All communication with external systems is API-driven.

• Microservice-enabled to integrate with 3PP (eg. CRM).

SaaS – On-Premise / Hosted (Managed/Cloud)

• Solution operates as a Service.

• Receives data from a Credit Provider.

• Automates the send/receive cycle between Provider and Credit Bureaux.

• Minimal human intervention, maximising security of data.

Online & On-site Training

• High-level, product-specific internal User Help.

• Context-sensitive help on all critical fields.

• All documentation (User and Admin) is available online.

• User and Admin training is available upon request.

Tailored Online & Telephone Support

• 5x8 Support is included in the SaaS license fee.

• Telephone and email support based on defined SLAs.

• Extended Support can be provided upon request.